Automated VAT threshold tracking and registration with Quaderno

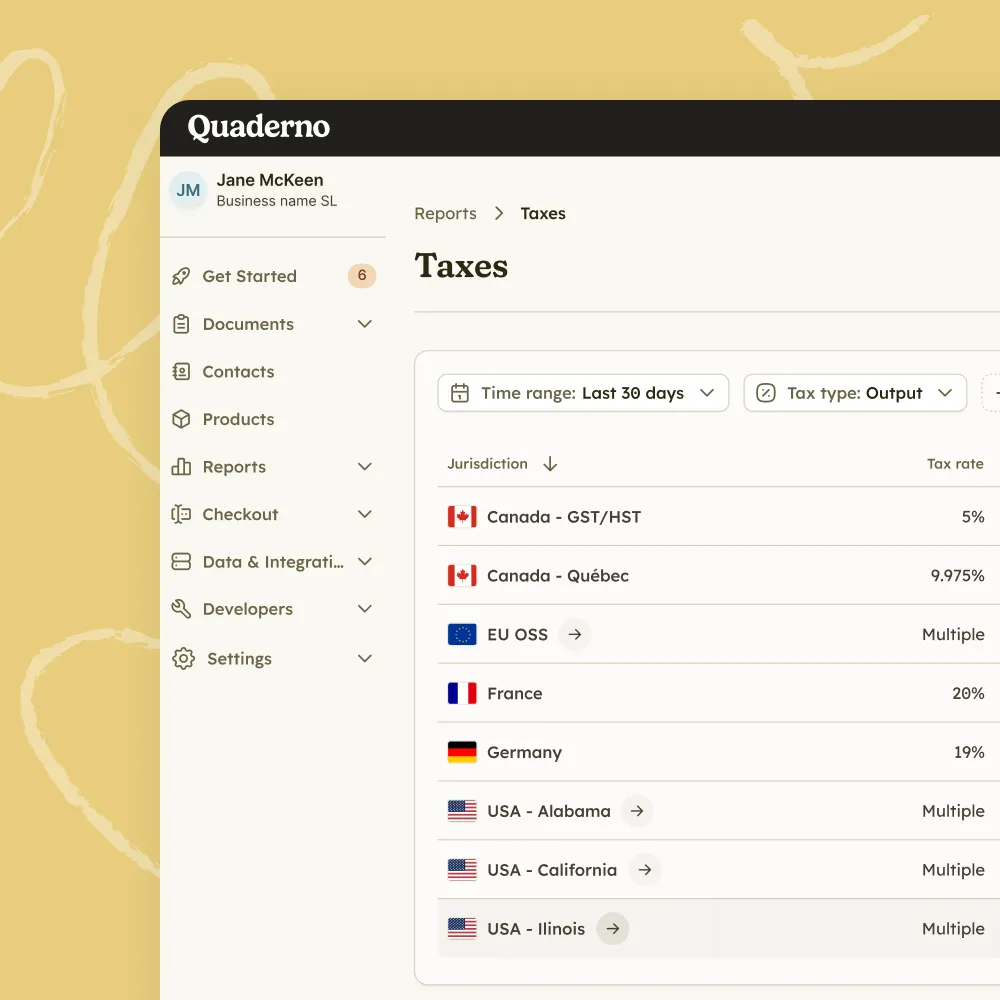

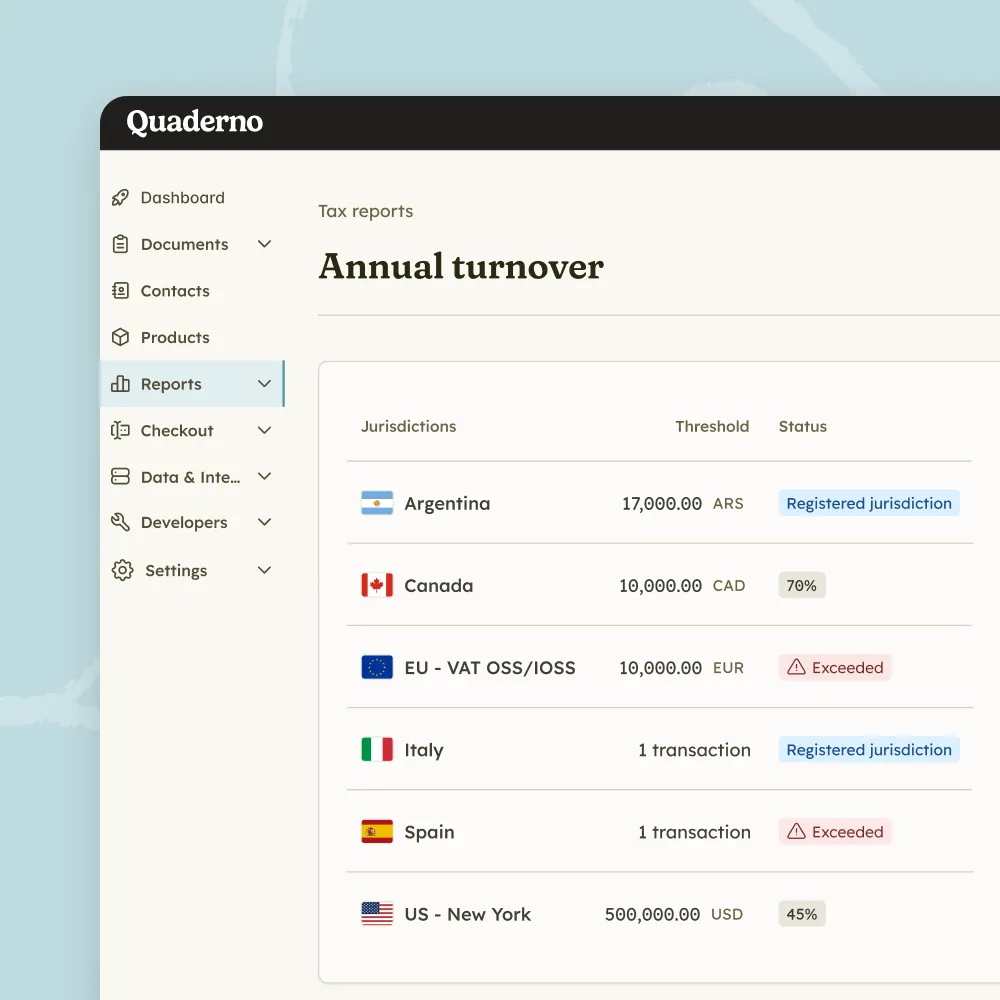

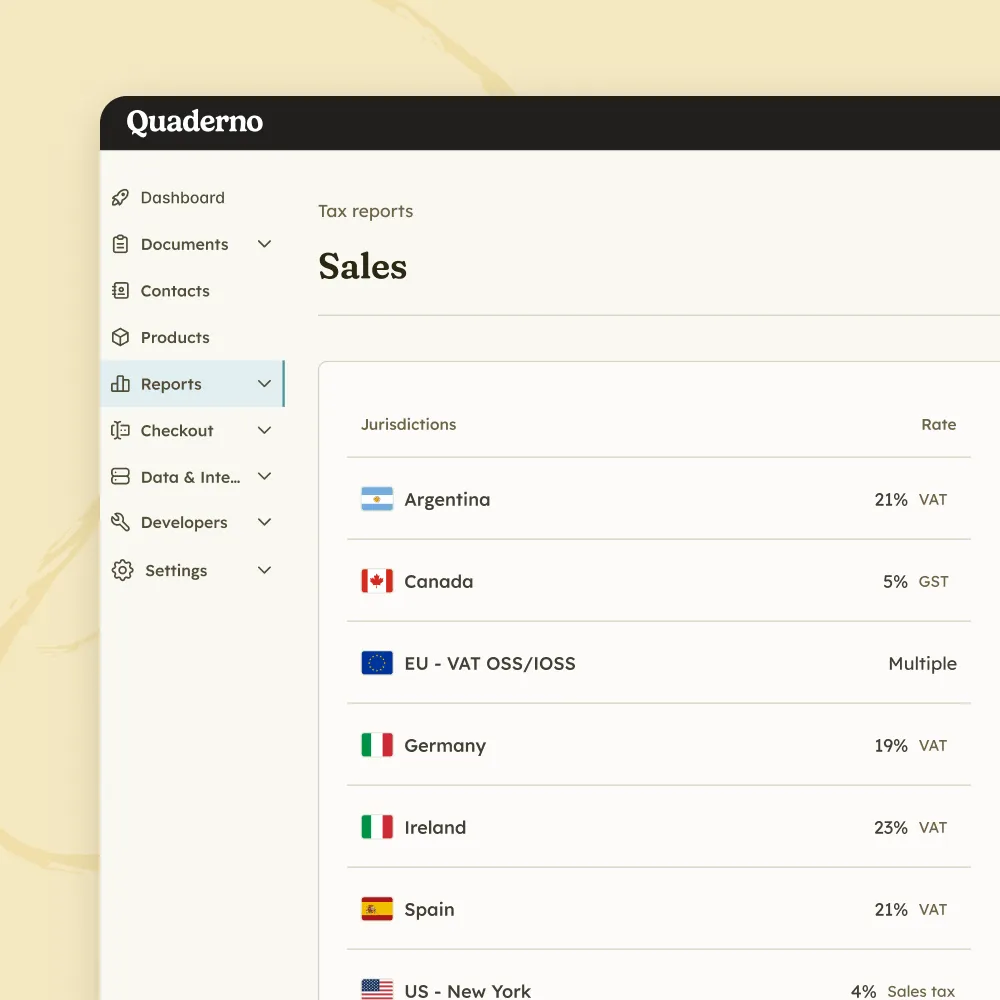

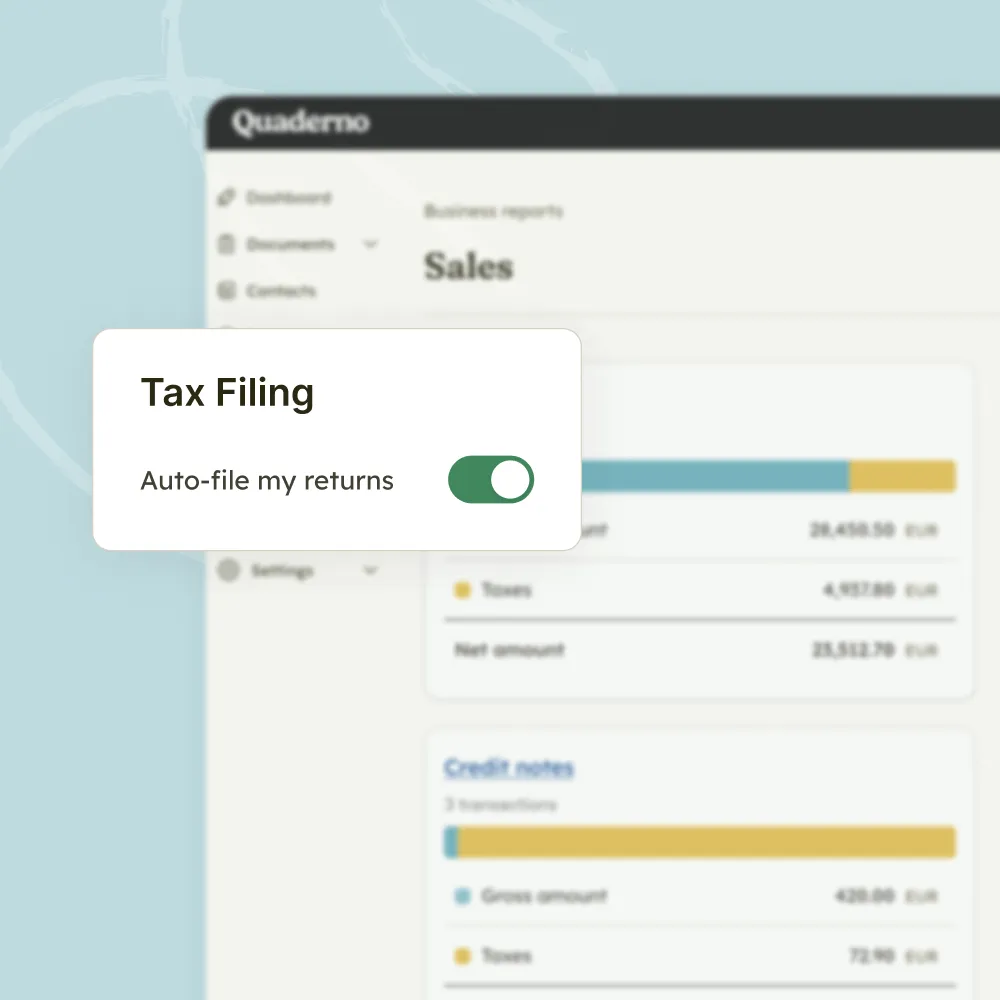

Quaderno continuously monitors your sales against every required VAT threshold worldwide. Eliminate spreadsheets, get real-time alerts, and ensure accurate, automated compliance globally.